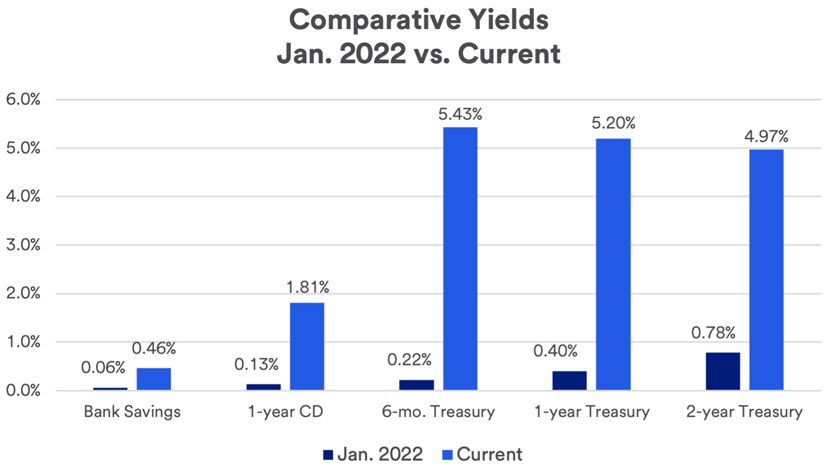

As indicated in the chart, Treasury rates currently move lower as maturities increase (i.e., a six- month Treasury bill pays more than a 1-year Treasury bill, which pays more than a 2-year Treasury). However, the yield differences today are marginal compared to what they were in 2023. This is an unusual situation, but Haworth notes that tax-sensitive investors who put money to work in municipal bonds must realize that a different yield environment exists in the tax-free market. “As opposed to the case for taxable bonds, municipal bond yields are tracking along a normal yield curve,” says Haworth. “Municipal bond investors can earn higher yields as they move farther out on the maturity spectrum.

Positioning for long-term goals

Resources not needed for near-term purposes can be invested with the objective of generating more attractive, longer-term returns. “Historically speaking, a diversified portfolio emphasizing stocks and bonds will outperform cash,” says Haworth. “In fact, despite today’s elevated yields for cash vehicles, a diversified portfolio of stocks and bonds likely generated superior performance in 2023.” Haworth says investors holding money in cash that is intended to help meet long-term goals should consider ways to put it to work more effectively.

“A first step is to move cash into short-term, lower-quality fixed income instruments that pay more attractive yields given the recent change in the interest rate environment,” says Haworth. He says investment grade corporate debt provides competitive rates, with municipal bonds also offering even more attractive tax-equivalent yields for individuals in higher tax brackets. Other options to consider are FDIC-insured bank savings accounts, which typically provide immediate liquidity, and certificates of deposit, available for various holding periods. Both vehicles offer more competitive yields than was the case prior to 2022.

Fixed income investments

Haworth says another sensible step may be to consider longer-term fixed income securities. “The Fed is expected to begin lowering interest rates at some point this year, though the timing of such cuts remains uncertain. Once rate cuts occur, yields will drop on short-term instruments,” says Haworth. “In this environment, locking in one-year or two-year yields on Treasury bills at today’s higher rates may be a smart move to protect short-term cash.” Haworth adds that for investors seeking to achieve long-term goals, it may be an opportune time to put more money to work in longer-term fixed income securities. For tax-aware portfolios, investors may consider municipal bonds with slightly longer than average durations, with a modest allocation to high-yield municipal bonds. Within taxable portfolios, consider a meaningful investment in non-government agency issued residential mortgage-backed securities while managing total duration with long-maturity U.S. Treasuries.

Equity investments

Beyond the bond market, Haworth suggests directing money back into equities. “While equity markets performed particularly well in 2023, investors should be prepared for more choppiness in the months ahead.” The S&P 500 gained more than 26% in 2023 and is up nearly 6% so far in 2024, although equity markets experienced significant price fluctuations. In this environment, dollar-cost averaging can be an effective strategy for shifting assets into stocks and bonds.

The opportunity cost of too much cash

When investors hold cash for too long, it typically results in an opportunity cost, relative to their goals and their long-term portfolio strategy. “Investors often pull money intended to achieve long-term goals out of markets after prices have already declined, then are hesitant to get back in until the markets have already recovered,” says Paul Springmeyer, senior vice president and regional investment director at U.S. Bank Private Wealth Management. “This is the risk of trying to time the market,” he says. “Too often, investors are late to return and miss a major part of the rebound.” This was true of investors who stayed out of the stock market in 2023 and early 2024, when the S&P 500 reached new highs for the first time in more than two years.