Managing cross-border payments in emerging markets

Navigate changing consumer behavior with service fees

ABCs of APIs: Drive treasury efficiency with real-time connectivity

Benefits of billing foreign customers in their own currency

Payment industry trends that are the future of POS

Addressing financial uncertainty in international business

Creating the ideal patient journey

3 benefits of integrated payments in healthcare

3 ways to make practical use of real-time payments

Instant Payments: Accelerating treasury disruption

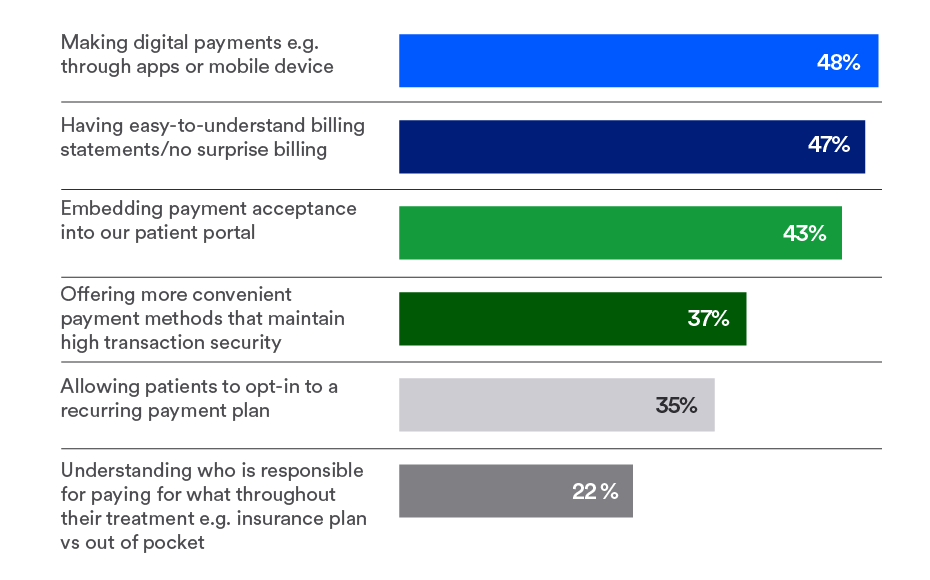

Standardizing healthcare payments

Take a fresh look: mass transit is going places

White Castle optimizes payment transactions

Webinar: CSM corporation re-thinks AP

Integrated payments healthcare benefits

Drive digital transformation with payments innovation

Unexpected cost savings may be hiding in your payment strategy

Want AP automation to pay both businesses and consumers?

Ways prepaid cards disburse government funds to the unbanked

Webinar: Approaching international payment strategies in today’s unpredictable markets.

Three healthcare payment trends that will continue to matter in 2022

5 reasons to upgrade B2B payment acceptance methods

Rent payments: What’s changing for commercial real estate

Consolidating payments for healthcare systems

ePOS cash register training tips and tricks

Restaurant surveys show changing customer payment preferences

Restaurant surveys show changing customer payment preferences

Transition to international ACH

Increase working capital with Commercial Card Optimization

Modernizing fare payment without leaving any riders behind

4 benefits to paying foreign suppliers in their own currency

3 reasons governments and educational institutions should implement service fees

A simple guide to set up your online ordering restaurant

Tap-to-pay: Modernizing fare payments pays off for transit agencies and riders

Tech tools to keep your restaurant operations running smoothly

The future of financial leadership: More strategy, fewer spreadsheets

The surprising truth about corporate cards

Understanding and preparing for the new payment experience

How Everyday Funding can improve cash flow

Demystifying ISO 20022

4 ways Request for Payments (RfP) changes consumer bill pay

Access, flexibility and simplicity: How governments can modernize payments to help their citizens

Automate accounts payable to optimize revenue and payments

Automate escheatment for accounts payable to save time and money

Banking connectivity: Helping businesses deliver the easier, faster, more secure customer experience of the future

Cashless business pros and cons: Should you make the switch?

Escheatment resources: Reporting deadlines for all 50 states

Higher education and the cashless society: Latest trends

How to improve digital payments security for your health system

Key considerations for online ordering systems

Role of complementary new channels in your payments strategy

5 winning strategies for managing liquidity in volatile times

How the next evolution of consumer bill pay makes it easier to do business

Managing the rising costs of payment acceptance with service fees

Safeguarding the payment experience through contactless

COVID-19 safety recommendations: Are you ready to reopen?

What corporate treasurers need to know about Virtual Account Management

Top 3 ways digital payments can transform the patient experience

Hospitals face cybersecurity risks in surprising new ways

Webinar: AP automation for commercial real estate

Crack the SWIFT code for sending international wires

How AI in treasury management is transforming finance

Making the cross-border payment decision: Wire or international ACH?

Can faster payments mean better payments?

Hospitals face cybersecurity risks in surprising new ways

Enhancing the patient experience through people-centered payments

Digital trends poised to reshape hotel payments

Transition to international ACH

Unexpected cost savings may be hiding in your payment strategy

Colleges respond to student needs by offering digital payments

Luxury jeweler enhances the digital billing and payment customer experience