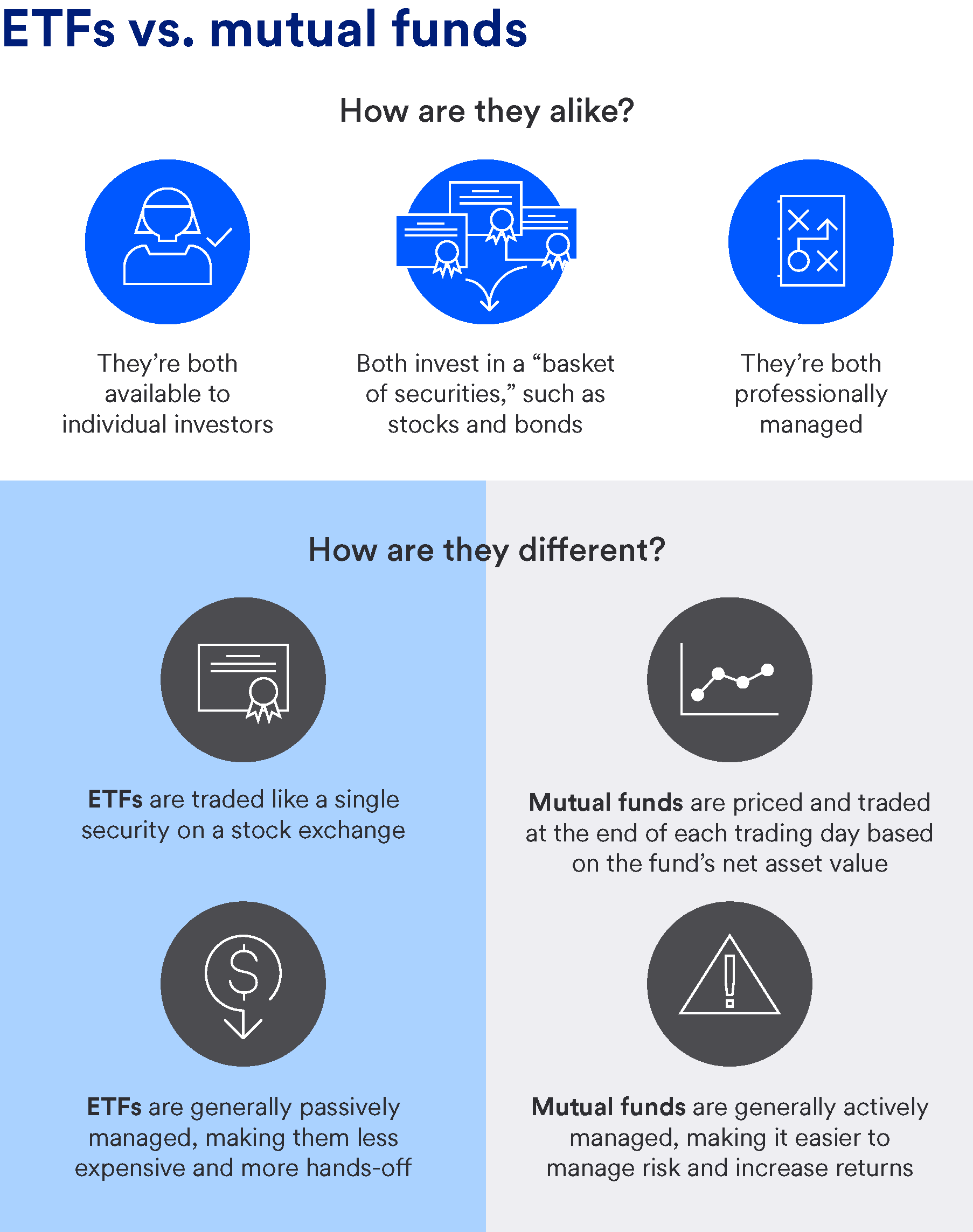

ETFs vs. mutual funds: How are they different?

The differences between ETFs and mutual funds start with how they’re constructed and traded. Even though they contain a basket of securities, ETFs are traded like a single security on a major U.S. stock exchange. ETFs can be bought and sold intra-day, just like any security.

In contrast, mutual funds are priced and traded at the end of each trading day based on the fund’s net asset value (NAV). “This means there’s less flexibility with regard to timing and price with mutual funds,” says Erickson. “ETFs give you more control over when to enter the market and at what price. On the flip side, you may need to pay a trading commission when you invest in an ETF, something that usually doesn’t apply to mutual funds.”

Also, most ETFs are passively managed. In other words, they’re designed to automatically track a market index, like the S&P 500. Most mutual funds, on the other hand, are actively managed, with the goal of outperforming a market index. As a result, ETFs are usually less expensive and more tax efficient than mutual funds since there is less turnover in securities and lower trading costs. It also means, however, that ETFs forgo the opportunity to manage risk or return relative to the bench they track..

The expense ratios for ETFs tend to be lower than mutual funds due to their passive management. In 2021, the average expense ratio for actively managed funds was 0.60%, compared with 0.12% for passively managed funds, according to the Morningstar 2021 U.S. Fund Fee Study.

Erickson notes that with their active trading, mutual funds tend to generate more capital gains than ETFs, which has tax implications for investors. “When securities in a mutual fund are sold at a gain, the gain is passed on to shareholders, who must pay capital gains tax even if they don’t sell their mutual fund shares,” she explains. For this reason, mutual funds may often held in tax-advantaged accounts like IRAs and 401(k)s, while ETFs are often held in taxable accounts, such as brokerage accounts.