What type of investor are you?

Saving vs. investing: What's the difference?

Understanding yield vs. return

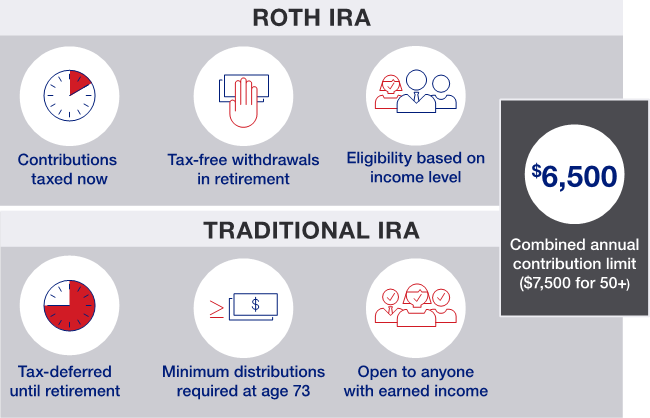

A beginner's guide to investing

Do your investments match your financial goals?

Start a Roth IRA for kids

Investment strategies by age

How to start investing to build wealth

5 questions to help you determine your investment risk tolerance

Robo advisors vs. financial advisors: How are they different?

Investing myths: Separating fact from fiction in investing

Guide for investing

5 financial benefits of investing in a vacation home

7 diversification strategies for your investment portfolio

Can fantasy football make you a better investor?

4 major asset classes explained

ETF vs. mutual fund: What’s the difference?

Effects of inflation on investments

4 times to consider rebalancing your portfolio

Why compound interest is important

What types of agency accounts are available for investors?

How much money do I need to start investing?