How to save for growing your LGBTQ+ family

Once you have come to a decision on how to bring a child into your life, it’s time to form a savings plan. When we asked Ann how she and her wife prepared financially, she said, “It’s just like planning for [any other] big financial goal. It goes back to any kind of big spending decision. Set aside ample time to plan for it as much as you can. Do as much online research as possible to have an idea of what you’re getting into. Take time to talk to a fertility doctor and clinic to get more precision around actual costs given your personal circumstances. You may or may not need to go right to IVF or the most expensive route. Estimate potential expenses, know what you can afford, and my best advice is set a budget. Having a ceiling to your spending will help you manage through the emotion side of the experience.”

Determine your financial goals

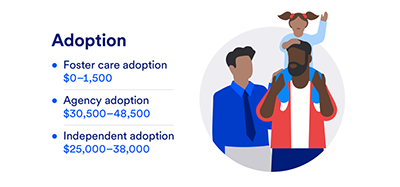

Growing your family will involve several goals on different timelines. There will be a cost of having a child, whether biologically or through adoption, and there will also be “new baby” needs, such as diapers, formula and a carrier. Another cost to tally is adoption by the non-biological parent after birth. Having gone through the second-parent process herself, Ann noted that they also had to obtain a lawyer. “That was another $1,500 to go through what seems like a pretty easy process. It was easy, but you have to find a lawyer that’s done this before, and sometimes that can be a little tough.”

Having a child also adds to your family’s cost of living, and depending on the size of your family, may require you to move to a larger home. Make a list of all the financial goals you must meet, as well as a timeline for when you need those funds available. This way, you can start saving for your most immediate needs first, while putting away smaller amounts for your less immediate goals.

If you need help structuring your finances to meet your goals, U.S. Bank offers free consultations with our goals coaches who can give you advice and help create a timeline.

Make a budget

The first thing you should do is sit down and review what is financially possible. How long will it take for you to save for a child? Can you afford the increase in healthcare, food and housing costs? Do you have unnecessary expenses that you can forego? Are you paying down debt in a fiscally responsible way, or could you consolidate or refinance for a smaller payment? Prioritize the goal of saving for the birth of your child first, but don’t jump into the process until you also have a reserved emergency fund.

Find support

The journey of having a child is a long and difficult one for queer people, so having support is crucial, whether that be financial, emotional or physical. If you need help reaching your financial goals, there are resources out there that could help. LGBTQ+ family building grants are made available to help queer families grow, offering trusts and scholarships.

For parents-to-be, having emotional support is just as important as having financial support. Bringing a child into your world is a complicated process, with many hurdles along the way. Luckily, there are lots of other parents who are on this journey with you who can relate. “You might feel like you’re alone,” said Ann when asked about her experience, “But LGBTQ+ people are everywhere. Same-sex couples having kids is becoming more and more common these days.” Take advantage of online social groups and forums and seek out other LGBTQ+ parents in your community. The internet is a treasure trove of information for parents navigating this tricky journey.

You also want to be supported by the medical and legal people helping you along this journey, like your doctor or lawyer. “You have to find a [clinic] that you’re comfortable with,” said Ann about her support system. “You have to feel welcome; you have to know that they’ve worked with other LGBTQ+ couples before. You have a choice in terms of your comfort level with your doctor, so take the time to interview them.”

Of equal importance is patience. When asked about hurdles she faced on her own journey, Ann had this to say: “I think for us, just like any other couple, this process just takes a lot of time and is definitely not for the faint of heart. The amount of bills you’re going to get and tracking it and spending time on the phone with healthcare providers… it’s an incredible amount of time. So just be prepared for that.”

Interested in learning more about how to plan financially for your growing LGBTQ+ family? Continue reading to learn more about your financial options and considerations.