Good money habits: 6 common money mistakes to avoid

Should rising interest rates change your financial priorities?

Multiple accounts can make it easier to follow a monthly budget

Your 4-step guide to financial planning

What is a good credit score?

Luxembourg's thriving private debt market

Top 3 considerations when selecting an IPA partner

How does money influence your planning?

Loud budgeting explained: Amplify your money talk

Webinar: Uncover the cost: Home renovation

Programme debt Q&A: U.S. issuers entering the European market

What type of loan is right for your business?

How liquid asset secured financing helps with cash flow

Hybridization driving demand

Maximizing your infrastructure finance project with a full suite trustee and agent

Evaluating interest rate risk creating risk management strategy

Lost job finance tips: What to do when you lose your job

Money Moments: How to finance a home addition

How to request a credit limit increase

Transitioning from the military to the civilian workforce

6 pandemic money habits to keep for the long term

Working with an accountability partner can help you reach your goals

Changes in credit reporting and what it means for homebuyers

How to increase your savings

How to gain financial independence from your parents

How to Adult: 5 ways to track your spending

Common small business banking questions, answered

How to track expenses

These small home improvement projects offer big returns on investment

Dear Money Mentor: What is cash-out refinancing and is it right for you?

5 financial goals for the new year

How to financially prepare for pet costs

Family planning for the LGBTQ+ community

Preparing for adoption and IVF

11 essential things to do before baby comes

Webinar: Uncover the cost: Starting a family

3 signs it’s time for your business to switch banks

4 small business trends that could change the way you work

Are you ready to restart your federal student loan payments?

3 tips for saving money when moving to a new home

Pros and cons of a personal line credit

Tips for handling rising costs from an Operation HOPE Financial Wellbeing coach

Tips to earn that A+ in back-to-school savings

Mindset Matters: How to practice mindful spending

Uncover the cost: Wedding

How to pay off credit card debt

5 tips to use your credit card wisely and steer clear of debt

How to build and maintain a solid credit history and score

How to improve your credit score

6 essential credit report terms to know

How to manage your finances when you're self-employed

Leverage credit wisely to plug business cash flow gaps

How to establish your business credit score

Streamline operations with all-in-one small business financial support

How to establish your business credit score

How to save money while helping the environment

7 steps to prepare for the high cost of child care

How to decide when to shop local and when to shop online

5 myths about emergency funds

Do I need a credit card for my small business?

What kind of credit card does my small business need?

How to save for a wedding

Stay on budget — and on the go — with a mobile banking app

5 things to consider when deciding to take an unplanned trip

How to talk to your lender about debt

5 tips for creating (and sticking to) a holiday budget

How can I help my student manage money?

7 steps to keep your personal and business finances separate

Key components of a financial plan

Don’t underestimate the importance of balancing your checking account

Credit: Do you understand it?

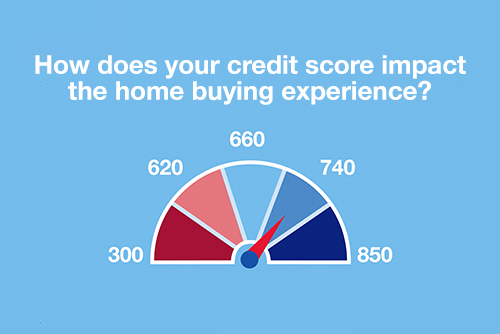

What types of credit scores qualify for a mortgage?

How to manage money in the military: A veteran weighs in

Credit score help: Repairing a bad credit score

Can you take advantage of the dead equity in your home?

Webinar: Mortgage basics: How much house can you afford?

Is a home equity line of credit (HELOC) right for you?

How to use your home equity to finance home improvements

Should you get a home equity loan or a home equity line of credit?

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

Are professional movers worth the cost?

Beyond the mortgage: Other costs for homeowners

Spring cleaning checklist for your home: 5 budget-boosting tasks

How to use credit cards wisely for a vacation budget

Which debt management technique is right for you?

5 steps to selecting your first credit card

Dear Money Mentor: How do I begin paying off credit card debt?

10 uses for a home equity loan

Know your debt-to-income ratio

Things to know about the Servicemembers Civil Relief Act

Should you buy now, pay later?

Steer clear of overdrafts to your checking account

U.S. Bank asks: Do you know what an overdraft is?

Tips for working in the gig economy

Tips to overcome three common savings hurdles

Save time and money with automatic bill pay

Helpful tips for safe and smart charitable giving

Growing your savings by going on a ‘money hunt’

Why a mobile banking app is a ‘must have’ for your next vacation

Tips to raise financially healthy kids at every age

How I kicked my online shopping habit and got my spending under control

It's possible: 7 tips for breaking the spending cycle

Financial checklist: Preparing for military deployment

Here’s how to create a budget for yourself

Common unexpected expenses and three ways to pay for them

Webinar: Common budget mistakes (and how to avoid them)

Allowance basics for parents and kids

9 simple ways to save

Do you and your fiancé have compatible financial goals?

3 ways to keep costs down at the grocery store (and make meal planning fun)

What military service taught me about money management

College budgeting: When to save and splurge

How to save money in college: easy ways to spend less

Costs to consider when starting a business

Should you give your child a college credit card?

Overdrafts happen: Steps to get you back on track

Adulting 101: How to make a budget plan

You can take these 18 budgeting tips straight to the bank

How I did it: Learned to budget as a single mom

Consolidating debts: Pros and cons to keep in mind

Myth vs. truth: What affects your credit score?

Improving your credit score: Truth and myths revealed

How to spot a credit repair scam

Decoding credit: Understanding the 5 C’s

Dear Money Mentor: How do I set and track financial goals?

What I learned from my mom about money

What financial advice would you give your younger self?

Practical money tips we've learned from our dads

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

How I did it: Deciding whether to buy an RV

Practical money skills and financial tips for college students

Money management guide to financial independence

Personal finance for teens can empower your child

5 unique ways to take your credit card benefits further

U.S. Bank asks: Transitioning out of college life? What’s next?

5 tips to use your credit card wisely and steer clear of debt

What’s a subordination agreement, and why does it matter?

Understanding the true cost of borrowing: What is amortization, and why does it matter?

What’s your financial IQ? Game-night edition

How to use debt to build wealth

How having savings gives you peace of mind

How to build credit as a student

30-day adulting challenge: Financial wellness tasks to complete in a month

Everything you need to know about consolidating debts

Webinar: Uncover the cost: College diploma

Your quick guide to loans and obtaining credit

Military homeownership: Your guide to resources, financing and more

U.S. Bank asks: Do you know your finances?

4 questions to ask before you buy an investment property

Good debt vs. bad debt: Know the difference

U.S. Bank asks: What do you know about credit?

7 financial questions to consider when changing jobs

How to best handle unexpected expenses