More space doesn’t have to come with an outrageous price tag. These tips can help you save money and determine how much home you can afford. We're here to help as you prepare for the homebuying journey.

Whether your family is growing or your hobbies are filling up the garage, sometimes a little extra room goes a long way toward improving your life. These tips can help you upgrade on space while staying on budget.

Start with research at your fingertips.

Now is the perfect time to browse real estate sites to determine where you want to live. Many websites will show you the approximate price of homes in a given area. You can also use mapping apps to determine how long it would take you to commute to work or go to your favorite places.

Prioritize what you need and what you can afford.

Make a list of must-haves in your next home. Think about where, specifically, you need more room. And what you’ll need in the next five to 10 years. You may find that while you can live without the large upgraded kitchen, the fourth bedroom and laundry room are non-negotiable.

Once you identify your must-haves, it’s equally important to know your budget. Use an online mortgage calculator to determine a target price range for your mortgage. Don’t forget to think about the added cost of maintenance, utilities and property taxes when planning your budget.

Save for a down payment.

The larger your down payment, the less you’ll spend on interest overall. Not to mention, you’ll enjoy a lower mortgage bill each month. Putting 20% down also means you could avoid paying for private mortgage insurance – which may cost as much as $1,000 a year! Despite popular belief, however, your down payment doesn’t have to be 20%. There’s no magic number; just make sure your down payment fits your financial needs. Get tips on choosing the right down payment for you.

So how do you save enough for a down payment? Homeowners usually cash out on equity when their home sells and then use that cash to fund a down payment. If you can’t wait for your home to sell, consider taking out two mortgages on your new home – you can pay off one mortgage when your old home sells and avoid paying for private mortgage insurance in the meantime.

Pay down your debt.

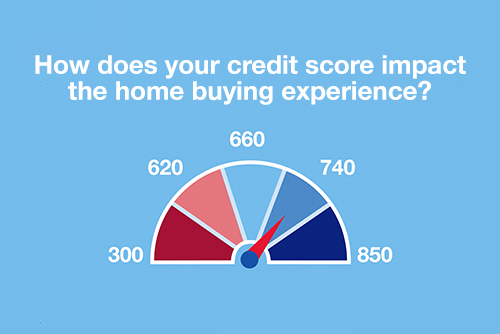

Debt can affect your credit score and can make it harder for you to get a low interest rate on your next mortgage. If possible, pay down your credit card balances and loans before applying for a mortgage.

Location, location, location

Do your research and determine whether you can save money based on your new home’s location. Make sure to take property tax and utility costs into account, and determine whether a location will add to (or hopefully save!) any costs associated with your current commute. The cost of groceries and everyday items can also fluctuate in different neighborhoods.

Fix up your home before selling – or buy a fixer upper. Ever heard of sweat equity? Putting some work into your current home can increase its value and selling price. If you’d rather fix up a home you can enjoy, consider buying a fixer upper at a lower price. You can customize the home and enjoy it for years to come.

Find the right mortgage.

The ideal mortgage supports your financial goals and can help you save money. Luckily, there are many mortgage options to choose from, with rates and terms that can be tailored to your needs. Talk with a mortgage loan officer to get personalized advice and information about today's market trends. And explore your options as a first-time homebuyer.

It’s time for your bigger, better dream home!

With careful prioritizing and planning, you can get the space you need and stay on budget. Good luck and happy house hunting!

If you’re ready to start your homebuying journey and have questions about the current market we're here to help. Reach out to a mortgage loan officer to discuss your situation.