Reviewing your beneficiaries: A 5-step guide

How to keep your assets safe

What is a CLO?

Insource or outsource? 10 considerations

Proactive ways to fight vendor fraud

5 Ways to protect your government agency from payment fraud

How to improve your business network security

The latest on cybersecurity: Mobile fraud and privacy concerns

Cybersecurity – Protecting client data through industry best practices

Fraud prevention checklist

Post-pandemic fraud prevention lessons for local governments

Fight the battle against payments fraud

Third-party vendor risk: protecting your company against cyber threats

Cybercrisis management: Are you ready to respond?

White Castle optimizes payment transactions

Webinar: Approaching international payment strategies in today’s unpredictable markets.

Increase working capital with Commercial Card Optimization

The future of financial leadership: More strategy, fewer spreadsheets

The surprising truth about corporate cards

Understanding and preparing for the new payment experience

Automate accounts payable to optimize revenue and payments

How to improve digital payments security for your health system

How to avoid student loan scams

Protecting cash balances with sweep vehicles

How to prevent fraud

Keep your finances safe and secure: Essential tips for preventing check fraud

How to spot an online scam

What is financial fraud?

Authenticating cardholder data reduce e-commerce fraud

Mobile banking tips for smarter and safer online banking

Why Know Your Customer (KYC) — for organizations

5 winning strategies for managing liquidity in volatile times

Protecting elderly parents’ finances: 6 steps to follow when managing their money

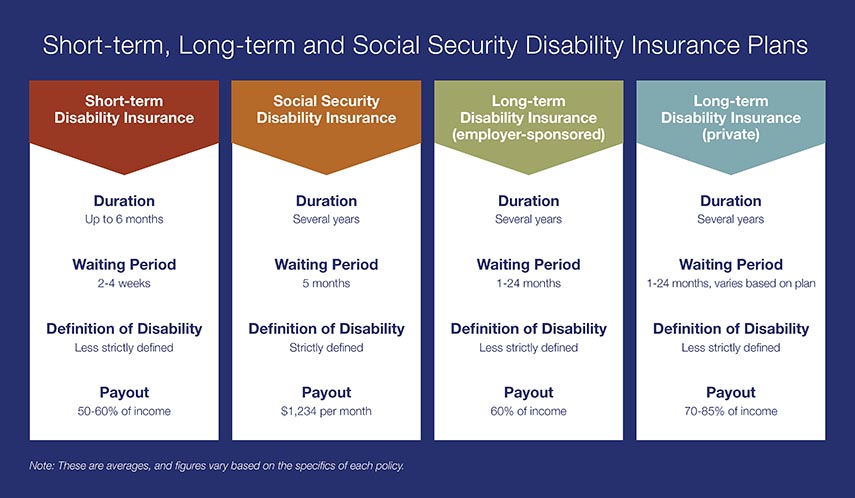

Is your employer long term disability insurance enough?

Why a mobile banking app is a ‘must have’ for your next vacation

Money muling 101: Recognizing and avoiding this increasingly common scam

From LLC to S-corp: Choosing a small business entity

Is online banking safe?

How-to guide: What to do if your identity is stolen

8 tips and tricks for creating and remembering your PIN

Recognize. React. Report. Caregivers can help protect against financial exploitation

Recognize. React. Report. Don't fall victim to financial exploitation

5 tips for seniors to stay a step ahead of schemers

Webinar: U.S. Bank asks: Are you safe from fraud?

Learn to spot and protect yourself from common student scams

The password: Enhancing security and usability

BEC: Recognize a scam

Hospitals face cybersecurity risks in surprising new ways

Cryptocurrency custody 6 frequently asked questions

4 ways to outsmart your smart device

30-day adulting challenge: Financial wellness tasks to complete in a month

How to protect your digital assets in your estate plan

Webinar: How to stay safe from cyberfraud

Webinar: CRE Digital Transformation – Balancing Digitization with cybersecurity risk

Hospitals face cybersecurity risks in surprising new ways

Webinar: CRE Digital Transformation – Balancing Digitization with cybersecurity risk

How you can prevent identity theft

What you need to know about identity theft