Reviewing your beneficiaries: A 5-step guide

Is a Health Savings Account missing from your retirement plan?

How to keep your assets safe

Multiple accounts can make it easier to follow a monthly budget

4 ways to free up your budget (and your life) with a smaller home

Webinar: Uncover the cost: Home renovation

Housing market trends and relocation impact

5 things to avoid that can devalue your home

What are conforming loan limits and why are they increasing

Key milestone ages as you near and start retirement

How to improve your business network security

Fraud prevention checklist

Post-pandemic fraud prevention lessons for local governments

Fight the battle against payments fraud

8 steps to take before you buy a home

Money Moments: How to finance a home addition

Checklist: 6 to-dos for after a move

How to avoid student loan scams

Protecting cash balances with sweep vehicles

What’s the difference between Fannie Mae and Freddie Mac?

High-cost housing and down payment options in relocation

How I did it: Bought a home without a 20 percent down payment

Crypto + Relo: Mobility industry impacts

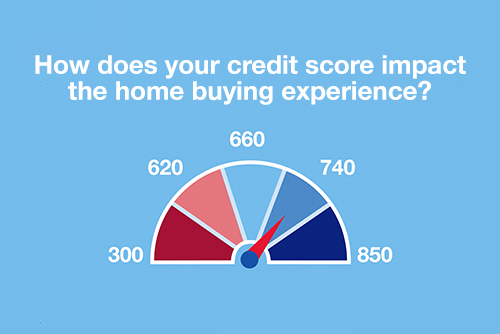

Changes in credit reporting and what it means for homebuyers

For today's relocating home buyers, time and money are everything

Checklist: 10 questions to ask your home inspector

Closing on a house checklist for buyers

These small home improvement projects offer big returns on investment

How to prevent fraud

How to spot an online scam

What is financial fraud?

Webinar: Mortgage basics: Finding the right home loan for you

5 financial goals for the new year

How to financially prepare for pet costs

The lowdown on 6 myths about buying a home

10 ways to increase your home’s curb appeal

Checklist: financial recovery after a natural disaster

3 tips for saving money when moving to a new home

5 ways to maximize your garage sale profits

Pros and cons of a personal line credit

For today's homebuyers, time and money are everything

Mobile banking tips for smarter and safer online banking

What is Medicare? Understanding your coverage options

Retirement plan options for the self-employed

How much life insurance do I need?

5 steps to take before transitioning your business

Protecting elderly parents’ finances: 6 steps to follow when managing their money

Planning self-care moments that matter (and how to finance them)

How to expand your business: Does a new location make sense?

Is raising backyard chickens a good idea financially?

7 steps to prepare for the high cost of child care

How to save for a wedding

How I did it: Turned my side hustle into a full-time job

How to test new business ideas

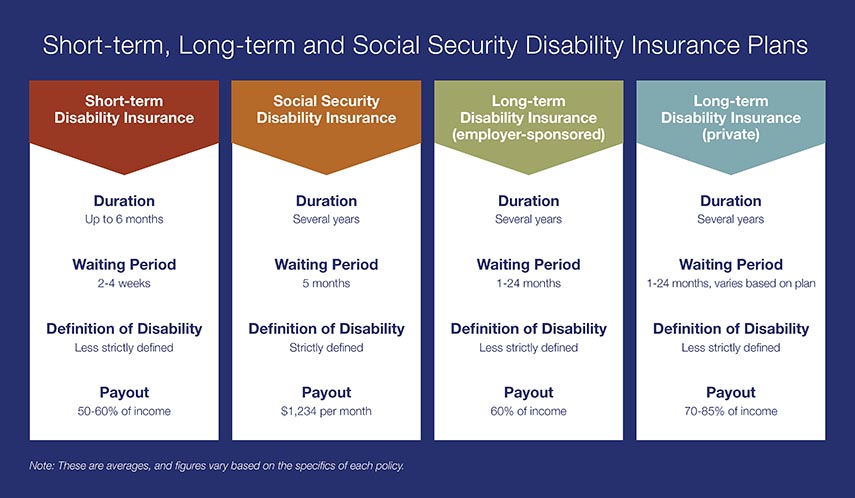

3 types of insurance you shouldn’t ignore

Is your employer long term disability insurance enough?

8 steps to choosing a health insurance plan

7 things to know about long-term care insurance

5 unexpected retirement expenses

Year-end financial checklist

Comparing term vs. permanent life insurance

Don’t underestimate the importance of balancing your checking account

How do I prequalify for a mortgage?

Can you take advantage of the dead equity in your home?

Home equity: Small ways to improve the value of your home

Webinar: Mortgage basics: How much house can you afford?

Is a home equity line of credit (HELOC) right for you?

Webinar: Mortgage basics: 3 Key steps in the homebuying process

Webinar: Mortgage basics: Buying or renting – What’s right for you?

How to use your home equity to finance home improvements

Webinar: Mortgage basics: What is refinancing, and is it right for you?

Should you get a home equity loan or a home equity line of credit?

6 questions to ask before buying a new home

What is refinancing a mortgage?

What is an escrow account? Do I have one?

Quiz: How prepared are you to buy a home?

10 questions to ask when hiring a contractor

What to know when buying a home with your significant other

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

What is a home equity line of credit (HELOC) and what can it be used for?

Dear Money Mentor: When should I refinance a mortgage?

Building a dream home that fits your life

Beyond the mortgage: Other costs for homeowners

How I did it: Bought my dream home using equity

Get more home for your money with these tips

Saving for a down payment: Where should I keep my money?

How I did it: Built living spaces to support my family

Managing the impacts of appraisal gaps in a hot housing market

Is it the right time to refinance your mortgage?

Spring cleaning checklist for your home: 5 budget-boosting tasks

Overcoming high interest rates: Getting your homeownership goals back on track

Home buying myths: Realities of owning a home

House Hacks: How buying an investment property worked as my first home

Should you buy a house that’s still under construction?

10 uses for a home equity loan

Know your debt-to-income ratio

Your guide to breaking the rental cycle

Which is better: Combining bank accounts before marriage — or after?

Save time and money with automatic bill pay

Money Moments: 3 smart financial strategies when caring for aging parents

Is it time to get a shared bank account with your partner?

It's possible: 7 tips for breaking the spending cycle

Here’s how to create a budget for yourself

Common unexpected expenses and three ways to pay for them

9 simple ways to save

Do you and your fiancé have compatible financial goals?

Money muling 101: Recognizing and avoiding this increasingly common scam

From LLC to S-corp: Choosing a small business entity

Is online banking safe?

How-to guide: What to do if your identity is stolen

8 tips and tricks for creating and remembering your PIN

Recognize. React. Report. Caregivers can help protect against financial exploitation

Recognize. React. Report. Don't fall victim to financial exploitation

5 tips for seniors to stay a step ahead of schemers

Webinar: U.S. Bank asks: Are you safe from fraud?

Learn to spot and protect yourself from common student scams

Webinar: Uncover the cost: Building a home

Webinar: Mortgage basics: Prequalification or pre-approval – What do I need?

Adulting 101: How to make a budget plan

You can take these 18 budgeting tips straight to the bank

How I did it: Learned to budget as a single mom

4 ways to outsmart your smart device

Buying a home Q&A: What made three homeowners fall in love with their new home

Understanding guardianship and power of attorney in banking

What you need to know about renting

What’s in your emergency fund?

Personal finance for teens can empower your child

How to talk about money with your family

How to protect your digital assets in your estate plan

Money Moments: Tips for selling your home

How I did it: My house remodel

Webinar: How to stay safe from cyberfraud

Crypto + Homebuying: Impacts on the real estate market

How you can prevent identity theft

Preparing for homeownership: A guide for LGBTQ+ homebuyers