LGBTQ+ retirement planning: What you need to know

How to retire happy

Retirement income planning: 4 steps to take

7 beneficiary designation mistakes to avoid

Good money habits: 6 common money mistakes to avoid

Is a Health Savings Account missing from your retirement plan?

Multiple accounts can make it easier to follow a monthly budget

Your 4-step guide to financial planning

How grandparents can contribute to college funds instead of buying gifts

How does money influence your planning?

Webinar: Uncover the cost: Home renovation

Do your investments match your financial goals?

Retirement expectations quiz

Retirement savings by age

IRA vs. 401(k): What's the difference?

Key milestone ages as you near and start retirement

Preparing for retirement: 8 steps to take

3 reasons governments and educational institutions should implement service fees

Higher education and the cashless society: Latest trends

How to avoid student loan scams

Working with an accountability partner can help you reach your goals

What to do with your tax refund or bonus

How I did it: Bought a home without a 20 percent down payment

Checklist: 10 questions to ask your home inspector

Closing on a house checklist for buyers

How to build wealth at any age

Investment strategies by age

5 financial goals for the new year

How to get started creating your business plan

The lowdown on 6 myths about buying a home

What documents do you need after a loved one dies?

Checklist: financial recovery after a natural disaster

Rebuilding finances after a natural disaster

Preparing for adoption and IVF

11 essential things to do before baby comes

Webinar: Uncover the cost: Starting a family

Are you ready to restart your federal student loan payments?

Tips for handling rising costs from an Operation HOPE Financial Wellbeing coach

Tips to earn that A+ in back-to-school savings

Mindset Matters: How to practice mindful spending

Uncover the cost: Wedding

What is Medicare? Understanding your coverage options

What Is a 401(k)?

Using 529 plans for K-12 tuition

Retirement quiz: How ready are you?

Retirement plan options for the self-employed

How to open and invest in a 529 plan

How much life insurance do I need?

Managing the rising costs of payment acceptance with service fees

5 steps to take before transitioning your business

Make your business legit

Talent acquisition 101: Building a small business dream team

5 things to know before accepting a first job offer

How to save money while helping the environment

7 steps to prepare for the high cost of child care

How to save for a wedding

How I did it: Turned my side hustle into a full-time job

5 things to consider when deciding to take an unplanned trip

How to talk to your lender about debt

Stay committed to your goals by creating positive habits

5 tips for creating (and sticking to) a holiday budget

How to test new business ideas

How can I help my student manage money?

Bank from home with these digital features

3 types of insurance you shouldn’t ignore

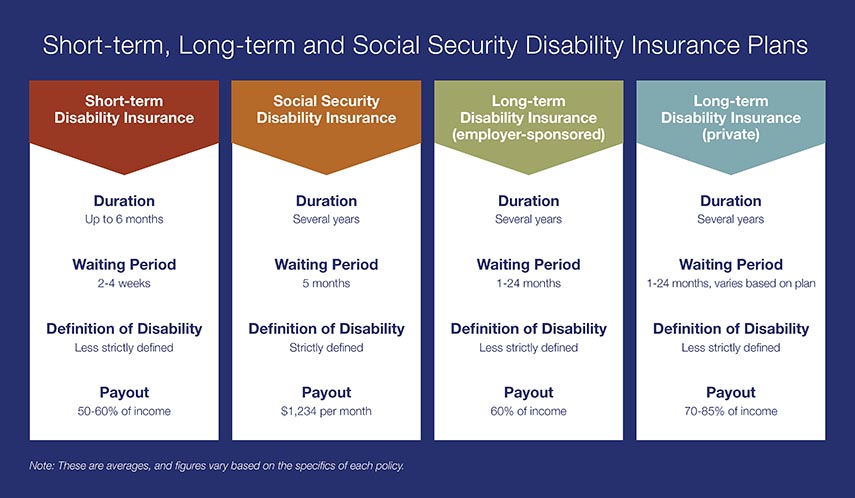

Is your employer long term disability insurance enough?

8 steps to choosing a health insurance plan

7 things to know about long-term care insurance

How I did it: Switched career paths by taking an unexpected pivot

5 unexpected retirement expenses

Year-end financial checklist

Key components of a financial plan

Comparing term vs. permanent life insurance

Achieving their dreams through a pre-apprenticeship construction program

6 questions students should ask about checking accounts

A guide to tax diversification and investing

Credit: Do you understand it?

What is an escrow account? Do I have one?

Home buying myths: Realities of owning a home

Webinar: 11 insider tips for student debt

Is a home equity loan for college the right choice for your student

How to apply for federal student aid through the FAFSA

U.S. Bank asks: Do you know what an overdraft is?

Tips to overcome three common savings hurdles

Money Moments: 8 dos and don’ts for saving money in your 30s

Helpful tips for safe and smart charitable giving

Growing your savings by going on a ‘money hunt’

Friction: How it can help achieve money goals

It's possible: 7 tips for breaking the spending cycle

What to consider before taking out a student loan

Here’s how to create a budget for yourself

Are savings bonds still a thing?

Allowance basics for parents and kids

9 simple ways to save

Do you and your fiancé have compatible financial goals?

What military service taught me about money management

Webinar: U.S. Bank asks: Are you safe from fraud?

Learn to spot and protect yourself from common student scams

College budgeting: When to save and splurge

How I did it: Paid off student loans

The A to Z’s of college loan terms

How to save money in college: easy ways to spend less

Costs to consider when starting a business

Should you give your child a college credit card?

Webinar: Uncover the cost: Building a home

Adulting 101: How to make a budget plan

You can take these 18 budgeting tips straight to the bank

Your financial aid guide: What are your options?

Social Security benefits questions and answers

Working after retirement: Factors to consider

Personal loans first-timer's guide: 7 questions to ask

Dear Money Mentor: How do I set and track financial goals?

How to stop living paycheck to paycheck post-pay increase

What you need to know about renting

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

Practical money skills and financial tips for college students

Tips for navigating a medical hardship when you’re unable to work

Personal finance for teens can empower your child

5 reasons why couples may have separate bank accounts

U.S. Bank asks: Transitioning out of college life? What’s next?

Co-signing 101: Applying for a loan with co-borrower

How to use debt to build wealth

How to talk about money with your family

How to build credit as a student

30-day adulting challenge: Financial wellness tasks to complete in a month

Money Moments: Tips for selling your home

How I did it: My house remodel

Does your savings plan match your lifestyle?

Student checklist: Preparing for college

Resources for managing financial matters after an unexpected death

Webinar: Uncover the cost: College diploma

U.S. Bank asks: Do you know your finances?

Webinar: Bank Notes: College cost comparison

Healthcare costs in retirement: Are you prepared?

Parent checklist: Preparing for college

Financial steps to take after the death of a spouse